In today’s fast-paced and data-driven economy, finance departments face growing pressure to enhance their efficiency, accuracy, and strategic insight. Accounts Payable (AP) automation is a valuable tool that streamlines invoice processing, improves cash flow management, and provides real-time financial visibility. However, as the AP automation market expands, selecting the right technology partner has become increasingly complex.

This guide will walk you through the essential features to look for, the questions to ask, and the criteria to use when selecting an AP automation partner that aligns with your organization’s long-term goals.

Why AP Automation Is No Longer Optional

Manual AP processes are not just inefficient—they’re costly, error-prone, and difficult to scale. Businesses that automate their AP functions typically see:

- 60–80% reduction in invoice processing time

- Improved vendor relationships through timely payments

- Greater transparency in financial operations

- Stronger compliance and audit readiness

However, these benefits only come when you partner with a provider that offers the right mix of technology, industry expertise, and ongoing support.

Key Features of a High-Quality AP Automation Solution

A best-in-class AP automation platform should go beyond basic invoice scanning and approval workflows. Look for the following features:

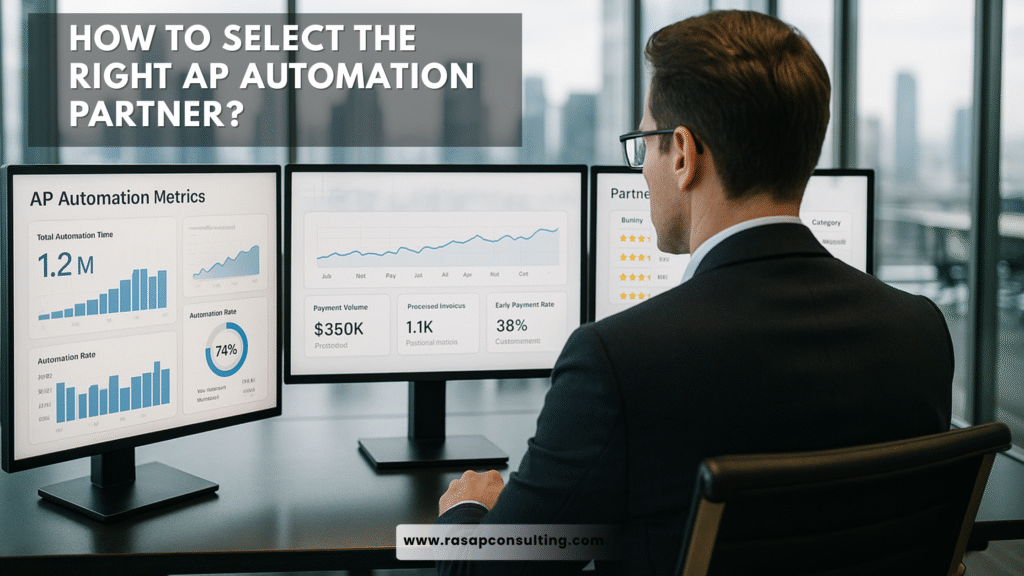

1. Real-Time Analytics & Dashboards

Gain instant insights into cash flow, outstanding invoices, early payment discounts, and bottlenecks.

2. Cloud-Based Infrastructure

Ensure secure, anytime-anywhere access for remote teams, with reduced IT overhead and automatic updates.

3. Artificial Intelligence & Machine Learning

Enhance invoice matching, flag anomalies, and minimize data entry errors with AI-powered tools.

4. ERP & Accounting Software Integration

Your AP solution should integrate seamlessly with your existing systems (e.g., SAP, Oracle, NetSuite, QuickBooks) to enable smooth data exchange and consistent financial reporting.

5. Touchless Invoice Processing

Automate the entire AP cycle—from invoice capture and validation to approval and payment—reducing manual intervention.

How to Evaluate a Potential AP Automation Partner

Finding the right partner is not just about technology—it’s about aligning with a vendor who understands your business, supports your team, and grows with you.

1. Industry Experience

Look for vendors with a proven track record of success in your industry. For example:

- Retail: High invoice volumes and seasonal spikes

- Healthcare: Strict regulatory compliance and supplier diversity

- Manufacturing: Complex supply chains and multi-location operations

Request case studies, client references, and performance metrics specific to your industry or vertical.

2. Global Capabilities & Regulatory Compliance

If your business operates internationally, your AP partner should:

- Handle multi-currency and multi-language requirements

- Comply with region-specific tax laws and electronic invoicing regulations (e.g., e-invoicing mandates in Latin America or the EU)

3. Customization & Scalability

No two finance departments are the same. Ensure your partner can:

- Tailor workflows and approval hierarchies to your processes

- Scale with your company’s growth—whether that means expanding to new geographies or integrating additional systems

4. Training & Ongoing Support

A successful AP automation rollout depends on user adoption. Evaluate:

- Onboarding resources and hands-on training

- Dedicated account managers

- 24/7 support availability and self-service knowledge bases

5. Innovation Roadmap

Technology evolves fast. Choose a partner that continuously invests in:

- AI-driven enhancements

- Mobile capabilities

- Real-time reporting features

- Integration with eProcurement and AR systems

A forward-looking provider will keep you competitive and ensure your investment remains valuable over time.

Questions to Ask Before Signing the Deal

- What is the average implementation timeline for companies like ours?

- How does your system integrate with our existing ERP?

- What security certifications does your platform hold?

- Can we configure workflows without developer support?

- How frequently do you release updates or new features?

- Do you offer SLAs (Service Level Agreements) for support?

Final Thoughts

Choosing the right AP automation partner is a strategic decision that can significantly impact your finance operations, compliance posture, and bottom line. Instead of simply comparing feature lists, evaluate potential vendors on their ability to:

- Understand your business

- Deliver measurable results

- Support your team at every stage

With the right partner, AP automation becomes more than a process upgrade—it becomes a competitive advantage.

Seeking a reliable AP automation partner?

Begin with a detailed needs assessment and request a personalized demo from top-rated providers, such as RAS AP Consulting, to see how their platform aligns with your workflow.